Interest rates rise to 4% from 3.5%, the highest level in 14 years

Publish Date: 02 February 2023

By Jade Shrubsole

Further reading

Today was The Bank of Englands press conference annoucing their full Monetary Policy Report.

The Bank of England raised its base rate from 3.5% to 4% - the highest in 14 years.

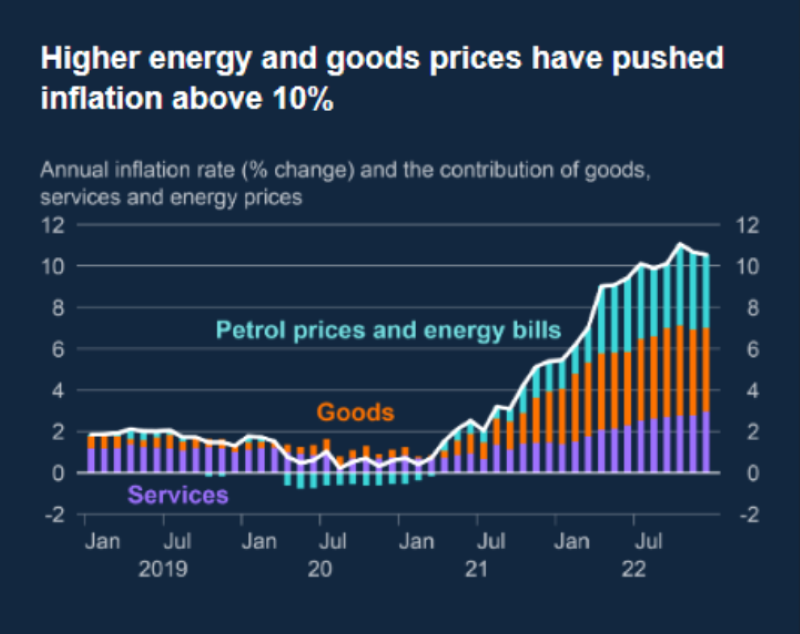

They report that the UK is set to enter recession this year but this will be shorter than previously thought. The Bank of England expects the economy to "fall slightly" in 2023 as energy costs and other prices continue to ease.

(Source Bank of England)

It also forecasts that the inflation rate will continue to slow this year and firms are likely to hold off on making redundancies.

(Source Bank of England)

A higher interest rate will be welcomed by savers, but have a knock-on effect for those with mortgages, credit card debt and bank loans, The 4% rise means people with a typical tracker mortgage will pay about £49 more a month - while those on a variable mortgage will pay another £31 a month.

The Bank says the UK is still set to enter recession this year, but this will be shorter than previously thought. The slump is now expected to last just over a year rather than almost two as energy bills fall and price rises slow.

To read the full Monetary Policy Report click here

Essential Information Group - News and Information

Keep up to date with our latest news, case studies and what's going on in the property auction industry on our blog.

Buying at auction

20/03/2025

Why the Property Auction Market is Booming Due to Stamp Duty Changes

The UK property auction market is experiencing a surge in activity in March 2025, driven primarily by impending changes to stamp duty regulations

Buying at auction

27/02/2025

Who Can Benefit from Buying a Property at a UK Property Auction?

Buying a property at a UK property auction can be advantageous for various buyers depending on their financial situation and goals. Auctions often offer unique opportunities, discounted properties, and a fast purchase process. Here’s who can benefit the most.

Buying at auction

24/02/2025

Bridging Loans Explained: A Guide for Property Auction Buyers

A bridging loan is a short-term financing solution, typically lasting up to 12 months. It provides immediate funds to bridge the gap between purchasing a property and securing long-term financing.