October see’s the first property price drop in 15 months

Publish Date: 02 November 2022

By Jade Shrubsole

Further reading

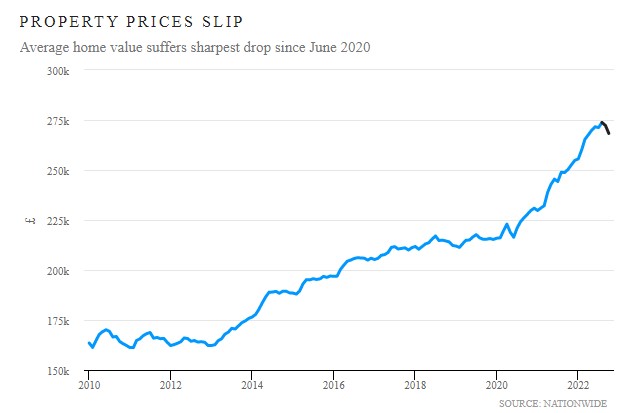

October see’s the first property price drop in 15 months according to Nationwide. The average house price is now £268,282 down from £272,259. The slip in property prices for October is likely caused by ever growing speculation of rising interest rates as well as the impact of the September mini budget. October saw house price growth slow to 7.2% again raising the subject of whether we are seeing a ‘price correction’ rather than a ‘price crash’ in a market that has seen house prices rise steeply over the last 5 years.

Nationwide announce sharpest drop in house prices since June 2020:

As with any statistics for the property market it will be hard to see the extent of the property price drop until next year due to the lag between sale agreed and land registry reporting completion.

The rise in exchanges this October in comparison with last October will likely be due to buyers rushing to complete sales before further interest rises are put in place.

In auctions we have seen the number of lots offered is up from 2,240 in October ‘21 to 2,336 in October ’22 a 4% rise. Whereas percent sold is down from 75% in October last year to 68% this October, a 9.8% drop.

Our October newsletter will be released in the next couple of weeks so we can take a closer look at the auction market statistics for the previous month and total amount raised. View all our monthly newsletters here.

Essential Information Group - News and Information

Keep up to date with our latest news, case studies and what's going on in the property auction industry on our blog.

Buying at auction

20/03/2025

Why the Property Auction Market is Booming Due to Stamp Duty Changes

The UK property auction market is experiencing a surge in activity in March 2025, driven primarily by impending changes to stamp duty regulations

Buying at auction

27/02/2025

Who Can Benefit from Buying a Property at a UK Property Auction?

Buying a property at a UK property auction can be advantageous for various buyers depending on their financial situation and goals. Auctions often offer unique opportunities, discounted properties, and a fast purchase process. Here’s who can benefit the most.

Buying at auction

24/02/2025

Bridging Loans Explained: A Guide for Property Auction Buyers

A bridging loan is a short-term financing solution, typically lasting up to 12 months. It provides immediate funds to bridge the gap between purchasing a property and securing long-term financing.